Do you have an IHT problem?

Inheritance Tax (IHT) is charged on the value of your estate above the current allowance when you pass away.

Many people assume it only affects the very wealthy, but with rising house prices, investments, and the inclusion of pension funds in April 2027 more and more families are being caught by it.

If you own property, savings, or other valuable assets, your estate could face a tax bill of 40% on everything above the threshold. We help you work out whether you’re likely to have an IHT issue.

Your Estate Plan

Inheritance planning isn’t just about tax – it’s about making sure your estate is passed on in the way you want. A clear estate plan sets out who receives what, when, and how, while also considering any tax implications. This might involve writing or updating your will, arranging trusts, or balancing gifts during your lifetime with protection for your own future needs.

We’ll work with you to create a personalised plan that reflects your wishes and provides peace of mind or provide an options report so you fully understand all avenues that are open to you.

With everything clearly set out, you’ll know your loved ones are looked after and your legacy is preserved.

What are your options?

Use Allowances

Make the most of your tax-free allowances, such as the nil-rate band and residence allowance. These can significantly reduce the value of your estate subject to tax.

Give Gifts

Passing wealth to loved ones during your lifetime can lower the size of your estate. Certain gifts are immediately exempt from IHT, while others become exempt after seven years.

Set up Trusts

Trusts can help protect assets, manage how they are passed on, and in some cases reduce IHT. They offer control and flexibility, especially for complex family situations.

Life Assurance

A life assurance policy written in trust can provide funds to cover any IHT liability, ensuring your heirs don’t need to sell assets quickly to pay the tax bill.

Business Property Relief Investments

Offer a way to reduce potential Inheritance Tax by investing in qualifying trading businesses for at least two years. This investment is higher risk so it’s important to get advice from a qualified adviser.

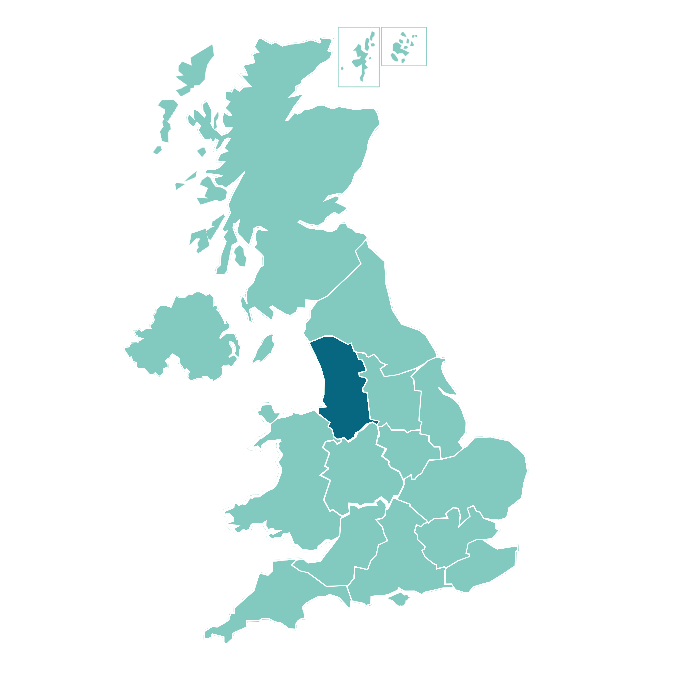

Interested in Inheritance Planning in the North West?

Contact us today for a free consultation on where to get started, or check out our social media for more information our advisors can give you the best guidance on where to start.

We cover the following areas in the North West: