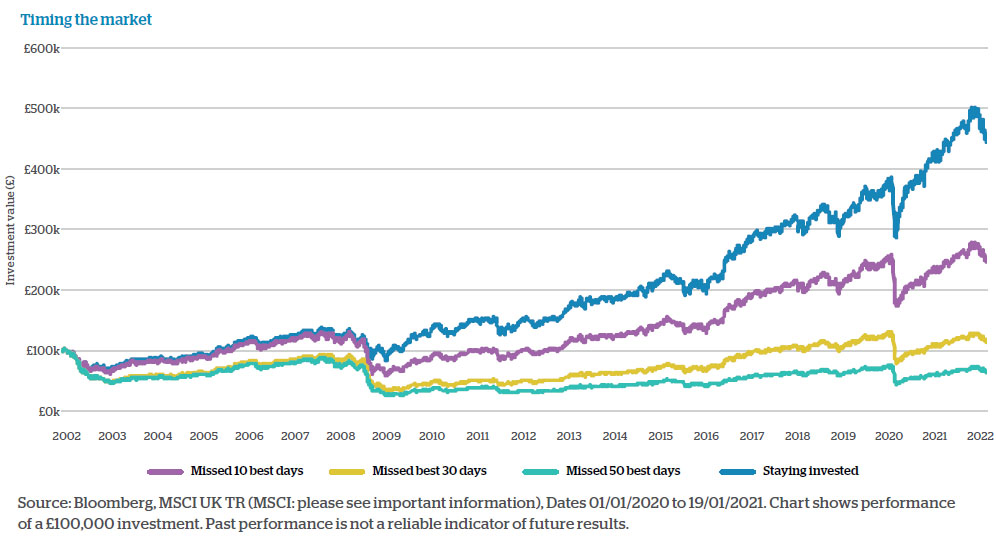

When markets fall and fear dominates, it can be difficult to resist the temptation to sell out of the financial markets and switch to cash, with the idea of reinvesting in the future when feeling more positive about market prospects, in essence trying to ‘time the market’. This is a strategy that carries with it the risk of missing out on some of the best days of market performance. And this could have a devastating impact on long-term returns.

Remaining invested may be an emotional rollercoaster during times of market stress, but research shows time and that this is the best investment approach over the long term.

Despite temptations to switch into cash, data shows that missing out on just the ten best days can have a big impact on long-turn returns. If you try to miss the lows you will probably miss the highs.

Staying fully invested during the ups and downs has resulted in an initial£100,000 portfolio, for example, having an ending value of £445,000, compared to £250,000 for those that missed the best 10 days in the previous 10 years. This effect also highlights the powerful effect of ‘compounding returns’ over time. If, for example, the best 50 days are missed, the long-term returns are indeed negative.

It’s important to look through the noise, and remain invested during times of market stress.